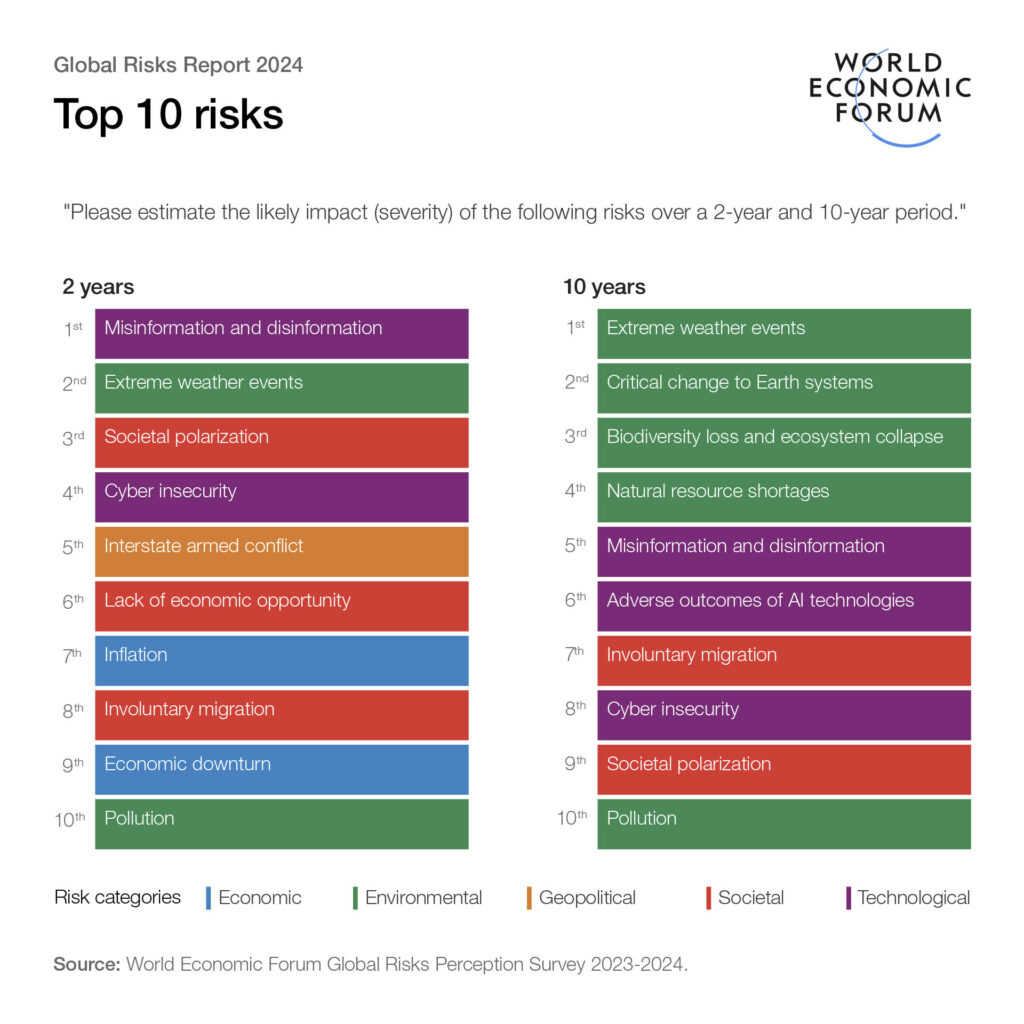

The world is shifting beneath our feet. Geopolitical risks—ranging from trade wars and sanctions to political instability and regulatory upheaval—are now among the top concerns for business leaders. According to the World Economic Forum’s 2024 survey, 83% of executives identified geopolitical tensions as one of the greatest threats to global economic growth, surpassing inflation (73%) and monetary tightening (68%). These figures are a stark reminder that navigating today’s global landscape demands more than business as usual.

In this high-stakes environment, the role of boards has never been more critical. A single geopolitical miscalculation can ripple across supply chains, disrupt operations, and erode shareholder confidence. Yet, within these risks lies an opportunity: companies that adopt a forward-thinking approach can enhance resilience, unlock new markets, and secure long-term growth.

This article offers a practical roadmap for directors, chairmen, and company secretaries to move beyond reactive risk management. By integrating geopolitical foresight into governance frameworks, boards can turn uncertainty into a strategic advantage. It’s time to embrace the challenge and equip your organisation to thrive in an era defined by complexity and change.

Understanding Geopolitical Risk

Geopolitical risk isn’t just about politics; it’s the intersection of economic, political, and social forces reshaping the business landscape. To grasp its scope, consider the multifaceted challenges businesses face today.

Economic Fragmentation and Trade Disruptions

The globalisation that once defined the world economy is giving way to economic fragmentation. Events like the Ukraine war and rising U.S.-China tensions have disrupted global trade routes and supply chains, forcing businesses to adapt or face operational setbacks. These disruptions are not theoretical; they manifest in tangible ways:

- Supply chain bottlenecks: Companies reliant on just-in-time inventory systems have experienced delays and increased costs due to restricted trade routes.

- Regulatory and financial challenges: Sudden shifts in tariffs or sanctions, as seen in various trade disputes, can result in immediate financial losses and compliance hurdles.

The risks of economic fragmentation require boards to think critically about diversifying supply chains and building more resilient operating models.

Political and Social Instability

Political unrest and social upheavals have far-reaching implications for businesses. Regional conflicts can destabilise markets, while domestic unrest often influences consumer behaviour and brand loyalty. Additionally, companies operating internationally face growing scrutiny to align with regional governance standards:

- For example, the EU’s evolving environmental and social compliance regulations require companies to meet stringent standards or risk penalties and reputational damage.

- Businesses that fail to monitor political developments in key regions may find themselves blindsided by sudden regulatory changes or social movements.

For boards, this underscores the need for robust intelligence-gathering mechanisms to monitor regional stability and anticipate challenges.

Emerging Technologies and Cyber Threats

While digital transformation opens doors to innovation, it also introduces new risks:

- Cybersecurity vulnerabilities: The increasing adoption of AI and other digital technologies exposes companies to heightened risks of data breaches, particularly in regions with disparate privacy and cybersecurity laws.

- Regulatory inconsistencies: Governments worldwide have varying approaches to data protection and emerging tech regulation, creating a complex compliance landscape.

Boards must address these risks by prioritising cybersecurity, understanding regional tech laws, and ensuring robust governance frameworks for data protection.

Geopolitical events are now a top concern for businesses, with 83% of leaders identifying them as the primary threat to global economic growth, surpassing inflation and monetary tightening.

In this dynamic landscape, Sharon Constançon, CEO of Genius Boards, joins experts Dr. Ian Oxnevad and Mohamed Cassimjee to discuss actionable strategies for helping boards anticipate, mitigate, and navigate these complex risks to ensure resilience and strategic success.

Why It Matters to Boards

Geopolitical risks are no longer peripheral concerns relegated to government relations teams—they directly shape the strategic direction of businesses. For boards, failing to recognise these risks can lead to significant consequences:

Supply Chain Vulnerabilities:

- Political unrest or trade sanctions can lead to supply chain disruptions, driving up costs and delaying production timelines.

- For example, during the COVID-19 pandemic, geopolitical tensions exacerbated supply chain fragility, exposing the vulnerabilities of just-in-time inventory systems.

Regulatory and Compliance Risks:

- Boards must navigate a labyrinth of international regulations and sanctions. Missteps in compliance can result in hefty fines and reputational damage.

Reputational Challenges:

- Businesses operating in contentious regions may face public scrutiny, affecting brand perception and stakeholder trust.

Integrating Geopolitical Risk into Boardroom Strategy

To effectively address geopolitical risks, boards must embed them into the organisation’s broader governance and strategic planning processes. This involves rethinking how risks are identified, assessed, and mitigated.

Scenario Planning and Strategic Foresight

Scenario planning allows boards to explore potential geopolitical developments and their implications. By examining “what if” scenarios, boards can:

- Identify vulnerabilities within their operations.

- Develop contingency plans to mitigate potential disruptions.

- Prepare for a range of outcomes, from regulatory changes to market access challenges.

For example, during periods of heightened U.S.-China tensions, companies that proactively relocated supply chains to alternative markets like Vietnam or Mexico were better positioned to weather the uncertainties of trade tariffs.

Designating a Geopolitical Intelligence Officer

An emerging best practice is the appointment of a geopolitical intelligence officer—an individual or team tasked with monitoring global trends, analysing risks, and providing actionable insights. This role ensures that boards:

- Receive timely and accurate information on geopolitical developments.

- Incorporate geopolitical insights into strategic decision-making.

- Maintain a contrarian perspective to challenge assumptions and enrich discussions.

By centralising responsibility for geopolitical awareness, businesses can ensure a more cohesive and informed approach to risk management.

Enhancing Cultural Intelligence

Navigating today’s multi-polar world requires cultural sensitivity and awareness. Boards must understand the societal, historical, and cultural contexts of the markets in which they operate. Cultural intelligence can:

- Mitigate the risks of miscommunication and misunderstanding in cross-border operations.

- Foster trust and goodwill with local stakeholders.

- Uncover opportunities in emerging markets by aligning with local customs and preferences.

For example, a company entering an emerging market with a culturally sensitive approach may gain a competitive edge by building stronger community ties and avoiding regulatory pushback.

Accredited Board Reviewer

Providing independent Board Performance Reviews for enhanced Board effectiveness.

Governance and Resilience in the Boardroom

Resilience is built through proactive governance and robust boardroom dynamics. Boards must prioritise transparency, open dialogue, and adaptability to address geopolitical risks effectively.

Fostering Transparency and Robust Dialogue

Creating a safe environment for diverse perspectives is critical. Boards must empower directors and executives to raise contrarian views and challenge assumptions. This openness ensures that risks are thoroughly examined and blind spots are minimised.

Building Organisational Agility

Frequent scenario exercises and strategic discussions enhance agility, enabling organisations to adapt quickly to changing geopolitical landscapes. Boards should:

- Regularly revisit and update risk assessments.

- Establish triggers for activating contingency plans.

- Encourage cross-functional collaboration to ensure readiness at all levels of the organisation.

Lessons in Resilience

Supply Chain Resilience

Consider the case of a multinational consumer goods company that diversified its supply chain in response to escalating U.S.-China trade tensions. By establishing manufacturing hubs in multiple regions, the company minimised disruption and reduced reliance on a single market.

Adapting to Political Uncertainty

Another example is a financial services firm that successfully navigated Brexit by proactively adjusting its operations. By relocating key functions to EU member states, the company ensured compliance with evolving regulations and preserved market access.

Turning Risks into Opportunities

In some cases, geopolitical risks can create new opportunities. For instance, businesses that recognise the growing importance of the Global South have leveraged partnerships in Africa and Latin America to tap into emerging markets and diversify their growth strategies.

Key Takeaways for Boards

- Identify and Monitor Geopolitical Risks: Boards must treat geopolitical risks as dynamic and multifaceted, requiring continuous assessment and vigilance.

- Embed Geopolitical Foresight into Governance: Integrate geopolitical risk management into boardroom discussions and strategic planning processes.

- Invest in Expertise and Tools: Appoint intelligence officers and leverage advanced analytics to turn data into actionable insights.

- Recognise Opportunities Amid Risks: View geopolitical shifts not only as threats but as opportunities to innovate, diversify, and grow.

Embracing Geopolitical Risks as Opportunities

Geopolitical risks are no longer lurking on the periphery—they are at the heart of today’s business landscape. From shifting trade routes to the ripple effects of political unrest, these challenges demand not avoidance but mastery. Boards that treat these risks as catalysts for innovation rather than mere threats can transform their organisations into agile, forward-thinking leaders in their industries.

The path forward begins with integrating geopolitical foresight into governance frameworks. This means cultivating an environment where complex issues can be openly debated, risks are assessed with rigour, and strategies are flexible enough to adapt to rapid change. It’s about more than resilience—it’s about thriving in uncertainty.

The global order may be unpredictable, but it’s also brimming with opportunities for those willing to act decisively. Will your board have the foresight to redefine its role in this evolving landscape? Will you seize the chance to not just navigate risk but also shape the future?

The answers to these questions will determine which organisations emerge stronger and more competitive in the face of change. The time to act is now—equip your board, enhance your strategies, and embrace the complexity of today’s world with confidence and vision.

If you found this article insightful and want to explore how to strengthen your board’s approach to geopolitical risk, we’re here to help.

- Discover how Genius Boards can support you in navigating the complexities of risk management and modern governance.

- Gain access to our expert evaluation services, tailored strategies, and actionable recommendations.

- Have Questions? Whether it’s about board dynamics, culture, or strategic planning, our accredited board evaluators are ready to assist.

Please contact Sharon Constançon for a free, no-commitment conversation or contact us directly to explore how Genius Boards can empower your governance framework to turn uncertainty into opportunity.

References:

- World Economic Forum. (2024). The Global Risks Report 2024. Available at: https://www.weforum.org/publications/global-risks-report-2024/ [Accessed 12 Dec. 2024].

- South African Institute of International Affairs (SAIIA)

Cassimjee, M. (2024). A Strategic Alliance Global Order: Diplomacy in a Time of Flux. South African Institute of International Affairs (SAIIA). Available at: https://saiia.org.za/research/a-strategic-alliance-global-order-diplomacy-in-a-time-of-flux/ [Accessed 12 Dec. 2024]. - Infortal Worldwide

Infortal Worldwide. (n.d.). Geopolitical Risk Guide. Available at: https://infortal.com/whitepapers/geopolitical-risk-guide/ [Accessed 12 Dec. 2024].