For modern organisations, the company secretary is indispensable. Acting as the link between the board of directors, the executive team, and regulatory bodies, company secretaries ensure the smooth operation of a company’s governance framework.

However, occupying this distinctive position also brings various challenges and natural conflicts that need to be effectively managed. We share our insights into the 10 common natural conflicts faced by company secretaries and offer practical tips to empower them to fulfil their roles confidently.

1. Understanding Conflicts of Interest

At the heart of many challenges faced by a company secretary lies the potential for conflicts of interest, which often occur when personal interests clash with the best interests of the company.

Typically, these situations involve:

- Monetary Influences: Financial interests can sway decisions.

- Recognition and Status: Desires for personal accolades or career advancements conflict with impartial decision-making.

- Protective Behaviours: Efforts to safeguard personal positions or benefits often come at the cost of organisational welfare.

For instance, executives may push for decisions that benefit their personal agendas rather than the company’s long-term health. However, company secretaries are generally seen as pillars of integrity, prioritising the company’s welfare over personal gains.

In your role as company secretary, managing conflicts of interest effectively requires you to maintain a steadfast focus on what’s important for the company. Additionally, it is important to identify conflicts of interest that directors may not recognise. Regularly updating and maintaining these conflicts of interest, and ensuring they are stored in the required registers, is crucial.

Tip: Establish a robust system for declaring and managing conflicts of interest. Regularly update the register of interests and foster a culture of transparency to help pre-empt potential conflicts. Encourage board members to openly declare their interests to address these issues before they become problematic.

2. Managing Competing Demands

Company Secretaries often find themselves at the crossroads of various demands. They are seen as a resource by different departments, leading to competing demands on their time and expertise.

A company secretary often finds themselves as a pivotal resource, balancing the needs of the business with the demands of the board. This role places them at the intersection of:

- Business Versus Board Interests: Ensuring the company’s best interests while addressing board members’ expectations.

- Personal Aspirations: Aligning career goals with the organisation’s needs.

- Empowerment Challenges: Navigating the power dynamics between the Chairman, CEO, and the board.

Company secretaries frequently find themselves pulled in multiple directions, with various stakeholders vying for their time and expertise. This situation can lead to feeling overwhelmed and undervalued. The demands placed on a company secretary often span from administrative tasks to strategic advisory roles, making time management a critical skill.

3. Lack of Empowerment

A significant challenge for many company secretaries is the lack of empowerment and recognition from their superiors. Often seen merely as minute-takers, their broader strategic contributions can be overlooked.

To counter this, company secretaries should continuously educate their colleagues about the full scope of their role. This involves not only delivering high-quality work but also proactively communicating the value they add to governance and decision-making processes.

Building a strong case for the company secretary’s role as part of the senior executive team can also help.

Highlighting successful case studies where effective company secretarial work has positively impacted the company can provide tangible evidence to support this argument. Additionally, seeking professional development opportunities to stay abreast of best practices and regulatory changes can further bolster their authority and credibility.

In this podcast, our CEO, Sharon Constançon, shares her wisdom with company secretaries and governance professionals on overcoming role-specific hurdles, emphasising the importance of compartmentalising challenges, mastering feedback, and adopting strategies to stay composed under pressure.

She underscores the significance of maintaining calm, the art of initiating crucial conversations to mend strained relations, owning mistakes gracefully, and strategies to avoid the perception of being an obstacle, thereby establishing oneself as a pillar of trust and expertise.

4. Reporting Lines and Their Impact

The reporting lines for company secretaries can significantly impact their effectiveness.

Ideally, they should report to the CEO for operational matters and the Chairman for governance issues. This dual reporting structure helps maintain their independence and mitigate conflicts of interest. Reporting to positions like the Finance Director or Legal Counsel can create inherent conflicts:

Finance Director: May view the company secretary role through a cost-centric lens, undermining the broader governance responsibilities.

Legal Counsel: Creates potential conflicts of interest, especially concerning legal privileges and confidentiality.

Tip: Advocate for a reporting structure that aligns with best practices. Present a well-reasoned argument supported by industry standards to help you achieve this change. Highlight potential conflicts that arise from reporting to finance directors or legal counsel to strengthen your case.

5. Executive Leadership and Board Dynamics

Although often regarded as a minute taker, the company secretary should be integrated into the senior executive team, serving as a sounding board for the CEO and senior management. This role involves understanding the business thoroughly, offering insights, and mentoring directors. Reporting lines are crucial in empowering the company secretary to effectively fulfil their role.

The company secretary act as:

- Governance Rock: Providing stability and continuity in governance practices.

- Advisor to the Chair and CEO: Ensuring that board meetings are productive and aligned with governance principles.

- Mentor and Ally: Supporting directors and senior executives in understanding and fulfilling their governance roles.

Tip: Build strong relationships by developing trust and rapport with board members and senior executives. Be approachable and supportive to foster these connections. Act as a mentor to directors, helping them understand their governance responsibilities and how to fulfil them effectively.

Follow the link to find out more on Board Dynamics and Culture in our Knowledge Hub

6. Handling Sensitive Information

The company secretary is often privy to sensitive information and must handle it with utmost care. This role involves:

- Being an Honest Broker: Facilitating open communication while maintaining confidentiality.

- Keeper of Secrets: Balancing the need to share critical information with the obligation to protect the company’s interests.

- Building Trust: Ensuring that board members and executives trust the company secretary to handle sensitive issues

Having this knowledge places them in a delicate position where they must balance confidentiality with the need to act in the company’s best interests.

Tip: Assess whether sharing the information is necessary for the company’s long-term sustainability. If it is, the decision to disclose becomes clearer. Build a reputation for discretion and trustworthiness to be seen as a reliable confidant, which is crucial for your role.

7. Managing Stakeholder Expectations

Managing stakeholder expectations is another critical aspect of the company secretary’s role. Stakeholders, including shareholders, regulators, and employees, often have differing priorities and expectations. Balancing their diverse demands while ensuring regulatory compliance can be challenging.

Tip: Maintain open lines of communication with all stakeholders. Provide regular updates on governance matters and be transparent about the company’s performance and strategic direction to build trust and align expectations. Stay well-versed in regulatory requirements and best practices to ensure the company remains compliant and can proactively address potential issues.

Accredited Board Reviewer

Providing independent Board Performance Reviews for enhanced Board effectiveness.

8. Navigating Varied Governance Appetites

Company secretaries face significant challenges in navigating the various governance appetites within an organisation. The effectiveness of governance often hinges on the chair’s commitment to upholding strong governance practices. Many people view governance as an unnecessary expense, but having a solid framework can help a company operate efficiently and cost-effectively by getting things right the first time.

The company secretary can be a strong influence on the chair, guiding them to set the right governance tone from the top. This involves ensuring that the chair, board, and all departments understand the importance of the “comply or explain” regime, its value, and the value of a strong governance backbone.

However, this often puts the company secretary at odds with those who want to bypass rules or stretch regulations. The company secretary must position themselves as a facilitator, helping the board achieve its desired outcomes while ensuring compliance and adherence to good practices.

This requires diplomacy, a deep understanding of the organisation’s goals, and the ability to find compliant solutions that align with these goals without overstepping into the strategic domain of the CEO.

9. Guiding the Modern Governance Agenda

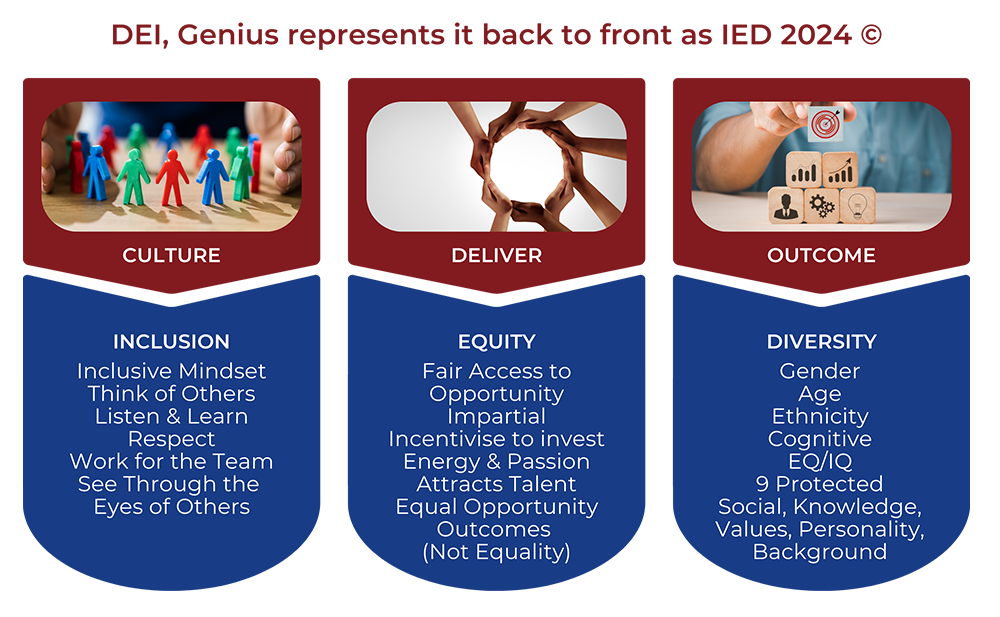

The modern agenda includes Environmental, Social, and Governance (ESG) responsibilities, Diversity, Equity, and Inclusion (DEI) initiatives, and the integration of Artificial Intelligence (AI). Reframing these priorities, with governance as the foundation, helps create a sustainable and inclusive corporate environment.

Company secretaries play a critical role in guiding and supporting their organisations by ensuring compliance and integrating these principles into corporate strategy. They facilitate effective board oversight of all aspects of the modern agenda, ensuring that related risks and opportunities are regularly included on board agendas.

This provides directors with the necessary information and insights to make informed decisions. By keeping the board apprised of evolving standards, regulations, and stakeholder expectations related to ESG, DEI, and AI, company secretaries enable proactive governance and strategic alignment with these objectives. They also facilitate the establishment of policies, foster an inclusive culture, and address environmental concerns.

However, implementing this modern agenda is not without its challenges. Company secretaries often face resistance to change.

- Cultural Resistance: Employees and board members may resist new policies or changes, especially if they perceive them as unnecessary or burdensome.

- Lack of Awareness: Stakeholders might not fully understand the importance of ESG, DEI, and AI, leading to reluctance in embracing these initiatives.

Navigating these challenges requires tact, education, and effective communication to ensure that the principles of the modern agenda are successfully integrated into the corporate strategy.

Educate the board and senior executives about the importance and benefits of ESG and DEI to foster a culture of inclusivity and sustainability. Approach challenges with tact, provide continuous education to stakeholders, and maintain effective communication to ensure successful implementation.

10. Maintaining Quality in Board Operations

The preparation of board packs and minute-taking are essential but often undervalued aspects of the company secretary’s role and include:

- Agenda Preparation: Ensure that board agendas and packs are comprehensive yet concise.

- Minute Accuracy: Maintain precise and objective minutes, resisting pressures to alter content for personal agendas.

- Priming the Board: Prepare the board to engage in meaningful discussions, focusing on strategic issues rather than operational details.

It is their responsibility to ensure that the board receives clear, concise, and accurate information, priming them to make informed decisions. However, conflicts often arise from differing expectations about the content and quality of these documents.

Concluding Thoughts on Embracing the Challenges

The role of a company secretary is undeniably complex and filled with numerous challenges and potential conflicts. However, by embracing these challenges and implementing practical strategies, company secretaries can navigate their roles effectively. Maintaining a clear focus on the company’s best interests, building strong relationships, and continuously advocating for the importance of good governance are key to succeeding in this pivotal role.

Company secretaries are more than just administrative support; they are the foundation of good governance, the guardians of corporate integrity, and the enablers of effective board dynamics. By recognising and addressing the natural conflicts that arise in their roles, they can ensure that they, and the companies they serve, continue to thrive.

If you found this article helpful and want to learn more about how to empower your role as a company secretary, feel free to get in touch.

- Find out how Genius Boards can help you navigate the complexities of modern governance.

- Engage with our accredited board evaluators for insights tailored to your needs.

- Request more information on our review process, approaches, and how we can support your board.

- If you have questions related to board dynamics, culture, composition, or structure, we’re here to help.