A Turning Point for DEI in Corporate Leadership

Diversity, Equity, and Inclusion (DEI) is at an inflection point. Once a widely accepted business imperative, DEI initiatives now face growing scepticism, economic pressure, and political scrutiny. High-profile corporations such as Meta, Amazon, and McDonald’s have recently scaled back their DEI programs, fueling a larger debate: Is DEI losing relevance, or is it evolving?

For boardrooms, the question is no longer “Should we prioritise DEI?” but rather “How do we embed DEI into governance to drive long-term success?”

Despite the recent Trump pushback, research continues to validate that companies with strong DEI practices outperform their peers in financial success, innovation, and talent retention. In our latest article we examine why boards should shift their DEI approach from a reactive initiative to a governance-led strategy, ensuring that DEI remains a sustainable business asset rather than a liability.

The Reality Behind the DEI Retrenchment

Media headlines suggest that corporations are abandoning DEI, but the reality is more complex.

- Economic Pressures – Budget cuts and cost-saving measures have led some companies to view DEI programs as expendable rather than integral to strategy.

- Legal & Political Uncertainty – The rollback of affirmative action in the U.S. has made companies hesitant to publicly maintain DEI commitments, fearing legal risks.

- DEI Fatigue & Skepticism – Employees have grown disillusioned with symbolic DEI initiatives that lack measurable impact, resulting in disengagement.

Yet, companies that view DEI as an integral part of governance and leadership rather than a temporary initiative consistently outperform their competitors.

According to a McKinsey & Company study, businesses in the top quartile for ethnic and gender diversity are 35% more likely to achieve financial returns above industry medians. Similarly, Boston Consulting Group (BCG) found that companies with diverse management teams generate 19% higher innovation revenue than those with less diverse teams.

Why? Diverse leadership encourages broader perspectives, more creative problem-solving, and a higher degree of market adaptability—factors that are essential for long-term business sustainability.

A Harvard Business Review analysis further underscores this point, revealing that diverse teams make decisions 87% faster and with 66% greater accuracy than homogenous teams. For boardrooms, this means that integrating DEI into governance structures isn’t just an ethical choice—it’s a strategic advantage.

“Companies with diverse management teams generate 19% more revenue from innovation than those with lower diversity levels.”Boston Consulting Group (BCG)

DEI Must Evolve into a Governance-Driven Approach

At Genius Boards, we believe that DEI should be an integral part of governance, risk management, and long-term corporate strategy—not a reactive HR program.

Why Boards Need a New DEI Framework

Many boards struggle with implementing DEI in a way that aligns with governance best practices. Traditional DEI models often:

❌ Over-emphasise representation metrics (hiring quotas) without addressing cultural transformation.

❌ Lack board accountability, relying on HR-led initiatives without strategic oversight.

❌ Fail to create sustainable change, leading to short-term programs that don’t deliver long-term impact.

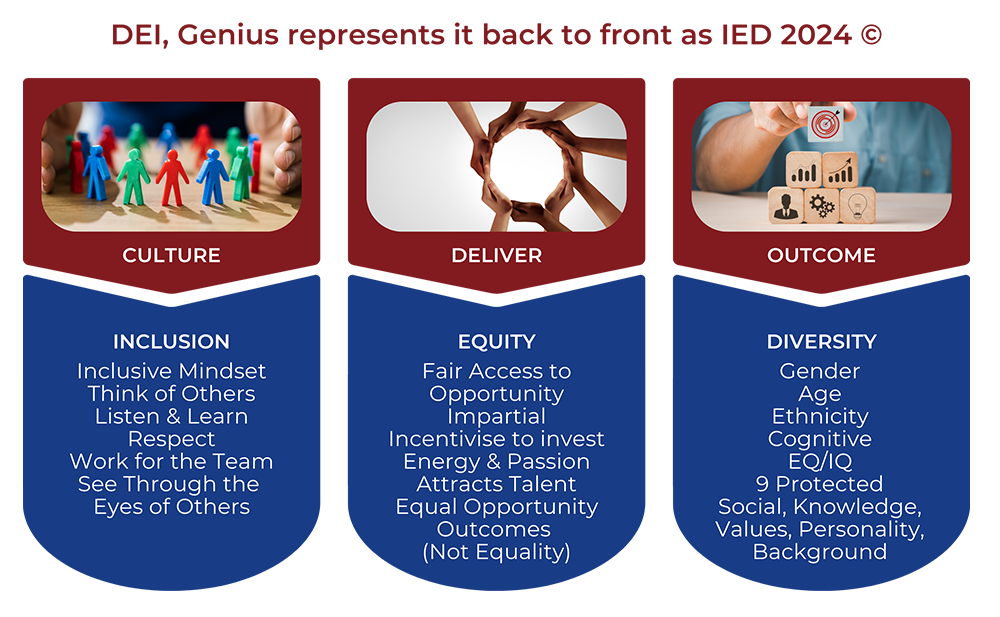

The Genius Boards Approach from DEI to IED

To solve these challenges, Genius Boards reframes DEI into a more strategic, governance-driven model—IED (Inclusion, Equity, Diversity).

🔹 Inclusion First → Companies should foster an inclusive culture at the leadership level before expecting diversity to thrive. Inclusion should be modelled by executives and embedded in decision-making processes.

🔹 Equity as the Driver → DEI should be policy-driven, not just awareness-driven. Governance structures should remove systemic barriers, ensuring fair pay, equal access to leadership, and unbiased hiring and promotion practices.

🔹 Diversity as the Outcome → Once inclusive leadership and equitable policies are in place, diversity will naturally increase without the need for artificial hiring targets.

This IED framework transforms DEI from a reactive compliance task into a proactive governance strategy that drives innovation, talent retention, and risk mitigation.

The Business Case for DEI: Risk, Reputation, and Talent Retention

Beyond financial performance, DEI is directly linked to talent retention and corporate risk management—two areas where boards cannot afford to be reactive.

Talent Attraction & Retention

Organisations that cultivate inclusive workplace cultures are significantly more likely to attract and retain top talent. A Deloitte (2023) study found that companies with strong inclusion policies are 2.3 times more likely to retain high performers.

Additionally, employee engagement is substantially higher in organisations that prioritise DEI. A Gallup (2024) survey revealed that companies with robust DEI strategies see a 30% increase in employee engagement, translating into higher productivity and overall workforce satisfaction.

From a recruitment standpoint, diversity is no longer a preference—it’s an expectation. Glassdoor reports that 67% of job seekers consider workplace diversity a key factor when evaluating job offers. Companies failing to embed DEI into governance risk losing access to top-tier talent and weakening their long-term workforce stability.

This is evident in the case of a leading Brazilian energy company, which recognised the severe underrepresentation of women in skilled trades and launched a board-led training initiative to increase gender diversity in electrical engineering. Within five years, the initiative led to a 35% increase in female electricians with a retention rate of 76%, expanding the talent pipeline and improving team diversity and operational efficiency.

Risk & Reputation Management

Investor confidence in DEI has grown significantly, with a 2024 Morgan Stanley report finding that 79% of institutional investors now consider a company’s DEI performance when making investment decisions. Likewise, PwC research reveals that companies with strong DEI policies are 45% more likely to be perceived positively by stakeholders and are less vulnerable to reputational risks.

One example of governance-led DEI impacting investor trust is Standard Chartered Bank’s introduction of a global, gender-neutral 20-week parental leave policy. The initiative improved leadership pipeline stability, increased female retention in mid-level management, and strengthened investor confidence, leading to a 17% increase in institutional investment interest—particularly from funds prioritising ESG and workforce equity.

For boards, the takeaway is clear: DEI is not just about representation—it is a governance imperative influencing talent strategy, investor confidence, and corporate reputation. Organisations that fail to embed DEI into governance structures risk financial underperformance, talent attrition, and long-term reputational damage.

“79% of investors now consider DEI performance a key factor in investment decisions.”Morgan Stanley (2024)

Rethinking DEI as a Boardroom Governance Strategy

For DEI to deliver measurable value, it should be treated as a governance priority, not an HR initiative. The following strategic adjustments ensure that DEI remains aligned with business objectives, risk management, and long-term corporate success.

Elevate DEI to a Governance Function

DEI should be embedded into boardroom decision-making rather than existing as a standalone HR initiative. Boards that integrate DEI into governance structures ensure that inclusion is not just a compliance checkbox but a driver of strategic growth.

📌 Key Actions:

- Make DEI an integral part of risk oversight, leadership succession planning, and executive performance evaluations.

- Shift DEI accountability from HR to C-suite and board-level Remuneration, Nomination, Risk and Governance committees.

- Establish clear KPIs that align DEI with business performance metrics, such as talent retention, leadership pipeline diversity, and decision-making efficiency.

Prioritise Inclusion and Equity as the Structural Foundation

Focusing on representation alone is an insufficient measure of success. Boards should assess leadership behaviours, internal culture, and workplace policies to ensure that inclusion and equity are embedded at every level.

📌 Key Actions:

- Conduct board-led culture audits to identify barriers to inclusion in leadership and decision-making.

- Ensure executive compensation and promotion pathways are structured to reflect equity, reducing bias in leadership selection.

- Implement governance frameworks that track workplace inclusion metrics beyond just demographic representation.

- If undergoing a board evaluation, external or internal, suggest that the diversity situation is

deeply reviewed and correlated to performance.

Align DEI with Business Growth and Competitive Advantage

Effective DEI strategies should enhance business outcomes, not operate in isolation. Boards that successfully integrate DEI leverage inclusion as a driver of innovation, reputation management, and long-term value creation.

📌 Key Actions:

- Position DEI as a core component of talent strategy—not just hiring but leadership development, retention, and engagement.

- Strengthen stakeholder trust by aligning DEI commitments with investor priorities and market competitiveness.

- Ensure DEI efforts are aligned with broader ESG commitments, supporting corporate sustainability and governance excellence.

By elevating DEI to a boardroom priority, organisations move beyond symbolic commitments and establish a structured, governance-driven approach that delivers measurable results in business performance, risk mitigation, and workforce engagement.

The Future of DEI in Boardrooms

Despite corporate retrenchment in some areas of DEI, the companies that master governance-led inclusion strategies will lead the next generation of sustainable businesses.

💡 Boards that integrate DEI into governance structures will be more resilient in a rapidly evolving business landscape.

💡 The IED model provides a long-term, risk-mature approach to inclusion that goes beyond reactive corporate diversity efforts.

This leads to the next critical question: If DEI is evolving, what other governance frameworks need rethinking?

In our next article, we’ll explore why diversity should be seen as the outcome of a well-structured governance approach rather than the starting point. Elaborating on Genius Boards’ IED Model (Inclusion, Equity, Diversity)—a framework that prioritises inclusion and equity first, ensuring that diversity emerges naturally from a strong cultural and structural foundation.

Accredited Board Reviewer

Providing independent Board Performance Reviews for enhanced Board effectiveness.

Genius Boards’ Commitment to Smarter Governance

At Genius Boards, we help leaders integrate governance-first strategies for DEI, ESG, and risk maturity. Would you like to explore how your board can future-proof its leadership approach? Contact Genius Boards for expert advisory and board governance solutions.

📢 Join the conversation: How is your board navigating the future of DEI?